Raising money for a startup is like sex. The more unattainable you seem, the better your chances of getting lucky. Also, the more interest you receive from others, the more appealing you will become to everyone else.

This essay discusses two psychological principles at work in an entrepreneur’s fundraising efforts: social proof and scarcity. Nir has discussed both in previous blog posts regarding product design. In this article, I’ll take you through the mechanics of each, and show you how entrepreneurs use these tools to close their rounds.

Social Proof

“If you’re walking down the street and everyone is looking up at the sky, you look up at the sky.” -Babak Nivi, AngelList

Social proof, in essence, is the herd instinct: people are more compelled to do something if others are already doing it. In the context of fundraising, social proof dictates that investors are more likely to invest in a company if others are already invested, or at least showing interest. This effect has more power if the initial investors are well regarded within the investor community. Social proof is why getting a commitment from the first investor in a round is significantly more challenging than the final investor: everyone is looking to somebody else to provide validation before they commit.

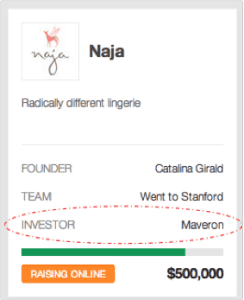

Social proof is the reason AngelList, a platform for startups trying to raise money, displays the names of current investors on the profiles of registered startups. Below is part of the profile for Naja, currently raising $500,000:

So how do shrewd entrepreneurs take advantage of social proof to close a round of funding? Firstly, if they have already taken money from investors, they advertise this fact in conversations with prospective backers. If they haven’t yet taken in money, they tell potential investors about positive signals and interest that they are receiving from others. When done correctly, this can create a feeding frenzy of interest.

Because of the power of social proof, the best approach to fundraising is to condense it into the smallest window of time possible. Ideally, entrepreneurs approach all investors at once. This increases the likelihood of being able to use verbal offers to drum up interest from others, which in turn they can use to attract still others. If companies are out in the market raising money for too long, they begin to run the risk of being perceived as “shopped,” as investors begin to wonder what is wrong with the business. This is the negative side of social proof and can create a death spiral where more and more investors stay away from a deal because they fear other investors are doing the same.

Companies also utilize social proof from name-brand advisors, which is one of the reasons many startups go to such great lengths to recruit industry icons in their respective fields. Endorsements from well-known funds and individuals will make a business more appealing.

Investors may argue that social proof is rational and indeed some VC funds are momentum investors whose explicit strategy is to follow the investments of so-called, “smart money.” We’ve even met investors who strictly do follow-on investments in companies who have received funding from one or more of a list of the top 30 funds within the last 90 days.

Some investors shun social proof. Fred Wilson says, “Make up your own mind. Don’t follow the herd. Don’t chase.” But that’s easier said than done. Social proof is an unavoidable component of the VC’s decision process, so successful startups learn how to use it to their advantage.

Scarcity

“The best entrepreneurs made me feel like the train was leaving the station whether I got on board or not.” Jon Callaghan, True Ventures

Scarcity is the principle that a person will be more compelled to act if he believes the opportunity will soon vanish — it’s why infomercials demand that you “order before midnight to receive half off!” In the context of fundraising, investors will be significantly more interested in participating in a financing round if they believe space is running out. Sufficient scarcity triggers a fear within an investor that he may be passing up on a big opportunity, increasing the chance he will invest. It is FOMO at its finest.

One way entrepreneurs utilize scarcity is by being transparent about how much there is left in a round when they are nearing its close. Investors are a lot more compelled to invest if there is $100,000 left in a $1m round then if there is $900,000 still available. I recommend keeping round sizes modest to test the waters initially and upsizing as the company garners more interest.

Without the perception of scarcity, there is a danger that a deal will grind to a halt. VC’s are incentivized to delay and retain optionality if at all possible: If an investment opportunity isn’t going to disappear, and the investor isn’t 100% sure about the investment (they almost never are), his best bet is to delay as long as he can (and gather more information as the company progresses) rather than turn the company down.

Why does it work like this?

So why do emotions play such a significant role in early stage investing? There are two primary reasons.

The first is that early stage venture capital is one of the most information-scarce forms of investing around. Let’s compare VC to hedge funds. When a hedge fund is evaluating a new investment in a publicly traded company, one of the first things the analyst will do is to build a financial model based on publicly available information, specifically historical financial and operating data from filings, press releases, and earnings calls. This data will form the cornerstones of the analysis and inform the ultimate investment decision.

Such information simply does not exist for early stage companies. They do not have financial reporting requirements. They do not have an operating history. And financial forecasts, especially at the very early stage, are frequently a little more than a starry-eyed guesstimate. The absence of data means emotions play a larger role in decision making than might otherwise be the case.

The second reason is that all human beings are wired to respond to social proof and scarcity. We tend to follow the herd and we automatically assume that scarce resources are more valuable. That’s why we observe social proof and scarcity at work in so many seemingly disparate spheres from the dating world to venture capital investing.

Photo Credit: kevin dooley

Note: This guest post is authored by Michael Simpson. Use discount code “nirandfar” to get 20% off his book, The Secret of Raising Money, until March 25th.

Related Articles

- Schedule Maker: a Google Sheet to Plan Your Week

- Cancel the New York Times? Good Luck Battling “Dark Patterns”

- How to Start a Career in Behavioral Design

- A Free Course on User Behavior

- User Investment: Make Your Users Do the Work

- Variable Rewards: Want To Hook Users? Drive Them Crazy

- The Hooked Model: How to Manufacture Desire in 4 Steps